ESG Comments | Blaget Bao’s environmental indicators are weak, the sales contract is default, and 30% after the Wind ESG score in the industry

Boatling ESG Comment

Source | Times Business School

Author | Bi Xiaolei

Edit | Zheng Shaona

EditorTheIn 2023, A -share listed companies attached great importance to ESG governance. The ESG report disclosure rate reached 34%, but at the same time, the controversy of ESG’s effectiveness of ESG was also accompanied.There is a phenomenon of “drifting green”, and falsification is falsified on the key indicators of ESG, which leads to inconsistent rating results to reality and violate the original intention of ESG development concept.Looking forward to 2024, all parties of the society need to amend the perception and expectations of ESG, and jointly promote the disclosure of ESG information into a new stage.

According to Flush iFind, as of March 20, nearly a hundred companies in A shares have disclosed ESG reports. Among them, on February 7, Functional Sugar Polaries (002286.SZ) released its “2023 social responsibility report report 2023)”(Hereinafter referred to as the” ESG Report “), became the first listed company in A shares to release the 2023 ESG report.

At this point, the Polaries have released the ESG report for 13 consecutive years. The earliest release of the year was in 2012. In the same year, only 17 companies released the ESG report in the A -share food industry (Wind 3, the same below).It accounts for less than 10%.

However, Times Business School checked the ESG report of the 2023 ESG report that as an agricultural and sideline food processing enterprise, the ESG report involved in the “environment (E)” dimension is short, the discussion is relatively weak, the carbon emissions are more weak, and the carbon emissions are discharged by carbon emissions.The key performance indicators such as resource consumption did not disclose detailed quantitative data, and at the same time lack of content comparing with the company’s historical performance.

In addition, in the “Social (S)” dimension, the key issues of Polarpy’s key issues such as disputes in buying and selling contracts and labor disputes have not been fully disclosed.

In response to the contents of the above -mentioned unintegosed content, on March 22, Times Business School issued emails and calls to inquire about baranties, and employees of the securities affairs department refused to respond to related issues.It stated that the company’s ESG report was voluntarily disclosed and was not determined. Therefore, regardless of the format and content, there is no need to strictly abide by relevant regulations.

Times Business School will start with the two dimensions of ESG report content interpretation and ESG report key indicators. Combining the latest institutional rating of ESG performance in the enterprise, the ESG report of the Boat Promise 2023 is comprehensively interpreted.

The main content of the main content is insufficient,“environment(E) “The indicator discussion is weak

From the perspective of the report structure, the Polaries 2023 ESG report has a total of 32 pages, and the effective information except the directory page and cover page has 25 pages.The overall framework is divided into six chapters, namely “About Boatling”, “Party Construction”, “Enterprise Governance”, “Related Party”, “Environmental Protection and Sustainable Development”, “Public Relations and Social Welfare”.

In contrast to the previous work, the length of the ESG report in 2022 is 34 pages, and the effective information is 27 pages. The overall framework is also divided into six chapters.Compared with the report, in 2023, the ESG report added a “General Manager speech” before the theme content. In 2022, the ESG report was only “the chairman’s speech.”

Judging from the company in the same industry, the same industry in the same industry is comparable to the company Bailong Chuangyuan (605016.SH).The content is divided into three chapters: “environmental information”, “social information” and “governance information”.

Therefore, the ESG report of Boatling in 2023 has not changed much in terms of main framework and length.However, compared with the comparison of the same industry, Puolingbao is slightly leading in the reporting space.

From the perspective of the specific chapters, the section of “About Boat Bao” mainly includes the introduction of the Boatling Company, the 2023 data overview, the corporate culture, the 2023 business overview, the historical honor, the new award in 2023content.This chapter has the longest space in the entire report, with a total of 7 pages.

existAt the level of “corporate governance (G)”, the practice of Boatling is mainly reflected in the two chapters of “Party Construction” and “Enterprise Governance”.

The “Party Construction Article” mainly introduced in detail to the party building work, activities and activities of Polaries in 2023, and the contribution of advanced model characters. This chapter has a total of 6 pages in length, second only to the “About Polaries” section in the proportion.Essence

The “Enterprise Governance Article” has only two pages, mainly including the legal person governance structure of the Polaries, the operation of the “three meetings” in 2023, and the establishment and amendment of the company’s governance system in 2023.

existAt the level of “Social (G)”, the practice of Bao Lingbao is mainly reflected in the two chapters of “stakeholders” and “public relations and social welfare articles”.

The content of the “Related Party” includes the protection of employees related to employees, employee care activities, human resources systems, information disclosure related to investors, related relationship management of suppliers and customersThe situation is also 6 pages.

The “Public Relations and Social Welfare Articles” mainly introduces the love donation activities carried out by Polaries in 2023 and visiting and condolences of employees and community masses.The length is 4 pages.

existAt the level of “environment (E)”, the practice of Bao Lingbao is only reflected in a chapter of “Environmental Protection and Sustainable Development”.

The “Environmental Protection and Sustainable Development” has a total of 3 pages, which mainly focuses on the influence of Boatling on the environment. The specific content is the company’s innovation, application and expansion of the company’s biotechnology and green manufacturing model, and as a high -quality supplier.Won the sustainable development award issued by Coca -Cola.

In summary, the length of the three main contents of the three main contents related to the “environment (E)”, “Society (S)”, “G)” “Society (S)”, “G)” in the 2023 ESG report is 3 pages, 10 pages, and 8 pages.Among them, there are fewer indicators disclosed in “environment (E)” and the content is relatively weak.

Lack of quantitative data comparison, insufficient disclosure of key issues of stakeholders

The annual annual report of Polaries shows that it is currently a leading company in the domestic sugar industry. The main products include functional sugar series, sugar alcohol series, dietary fiber series, starch and starch sugar series, pharmaceutical auxiliary materials series, and probe yuan terminal.

Bailong Chuangyuan’s half -annual report in 2023 also shows that it is mainly engaged in the research and development, production and sales of poipan series products, dietary fiber series products, healthy sweeter products and other starch sugar (alcohol) products.

It can be seen that Bailong Chuangyuan is closer to the main business of the bowling.Therefore, the Times Business School started from the three evaluation indicators of integrity, comparability, and substantiveness, and combined with the comparison with Bailongchuang Garden’s 2022 ESG report to analyze the ESG report in the 2023 ESG report.

2.1 Undaled key performance indicators, lack of historical performance comparison

The integrity of the ESG report refers to the integrity of the industry’s ESG general disclosure indicators and key performance index disclosure, and the report includes the concept, system, measures and performance of promoting ESG work; comparability refers to the keyWhen performance, it should be compared with the historical performance for many years and the performance of peers or similar companies.

about“Environment (E)” dimension content,The ESG report in 2023 only disclosed the relevant rules and regulations, and for the key performance indicators of this part of the content, Polaries did not disclose any waste gas, wastewater and waste discharge data, and did not disclose the electricity in 2023 in 2023., Water, natural gas and other resources.

Compared with the company in the same industry, Bailong Chuangyuan disclosed the chemical oxygen demand, nitrogen oxide, wastewater, sulfur dioxide, nitrogen oxide emissions, sludge, waste activated carbon and other general waste emissions data in the 2022 ESG report,And the discharge data of hazardous waste such as waste oil, waste packaging, and laboratory waste liquid; in terms of resource consumption indicators, Bailong Chuangyuan also disclosed data consumption data of gasoline, diesel, natural gas, electricity and water resources in the year.

also,about“Company Governance (G)” dimension contentIn the 2022 ESG report, Bailong Chuangyuan disclosed its board of directors to participate in and regulatory ESG governance, ESG management organizational structure, work system and related mechanism, while the Boatling Bao ignored the content in the 2023 ESG report.Essence

Therefore, the ESG report of Po Lunbao was lacking in integrity in 2023, lacks disclosure of key indicators such as carbon emissions, and did not compare with the company’s historical data.

2.2 Insufficient disclosure of key issues of stakeholders, claiming payments for failing to perform the contract in accordance with the contract30.9410,000 yuan

The substantialness of the ESG report refers to a comprehensive and in -depth disclosure of key issues that respond to related parties with important and substantial impacts.

The stakeholders ‘stakeholders’ main parties mainly include investors, customers, employees, suppliers, etc., but the company did not disclose its actual issues in detail in the 2023 ESG report.

In terms of indicators related to employee interests,Polaries disclosed related activities related to enrich the cultural and sports activities of employees and employee care. They simply disclosed relevant policies in regulating the management of labor relations management, compensation performance assessment, employee development and training.

For employees according to gender, age, employment type, regional and loss ratio, and employees to receive training ratios and average duration according to gender and employment types, Polaries have not disclosed in the 2023 ESG report.

In comparison, in the 2022 ESG report, Bailong Chuangyuan listed the structure and loss rate of the company’s employees in the year in the form of a data table, the employee occupation health and safety indicators, the employee training rate and employee training rate divided by gender and categoryCritical performance indicators such as average training duration.

In terms of indicators related to suppliers and customers,In the 2023 ESG report, Polybao also focused on policy introduction, and lack of insufficient disclosure of key performance indicators such as data divided by suppliers, the number of products, and response, and other key performance indicators.

In comparison, in the 2022 ESG report of Bailong Chuangyuan, key performance indicators such as the number of suppliers, customer satisfaction, product and service complaints and processing rates, product qualification rates, and product qualification rates were disclosed.

In addition, the Times Business School consulted the company to investigate that in 2022, the Polaries had a case of $ 4,4650 due to disputes in the sales contract, and did not disclose in the ESG report.

The specific situation is that because Booling Bao Company did not provide goods in accordance with the contract, Qingdao Oriental Yongde Trading Co., Ltd. (hereinafter referred to as “Oriental Yongde”) issued a lawsuit on the grounds of a trading contract., The People’s Court of the South District of Qingdao City, Shandong Province, the judgment of the Polaries must compensate the Oriental Yongde 4,4650 US dollars (equivalent to RMB 309,400 to calculate the exchange rate on the day of the judgment), and rejected other Eastern Yongde requests.No.: (2022) Lu 0202 Minchu No. 4470] Published on March 6, 2023.

At the same time, in 2023, there were still labor disputes in Polaries, but the company did not disclose it.According to the investigation of the enterprise, on August 18, 2023, the plaintiff Yang Moumou opened the trial of the first instance of the case on the grounds of labor disputes; as of March 21, the Yucheng People’s Court of Texas City, Shandong Province had not yet made a judgment on the case.Essence

As shown in Figure 2, according to the MSCI (Ming Sheng) ESG evaluation index system, “whether there is conflict with the stakeholders” is one of the four core issues that focus on the “social (S)” field.

In addition, according to the “How to prepare the Environment, Society and Governance Report” issued by the Hong Kong Stock Exchange, “the number of complaints about products and services and the method of response” is also a key performance indicator that is also concerned about the “Social (S)” field.First, this indicator mainly reflects data and explanations related to the performance of enterprises and customer service.

However, in the 2023 ESG report, none of the sponing treasures were explained in detail for the content and process of the two lawsuits related to the two lawsuits related to Yang Moumou’s labor disputes with Yang Moumou.

Wind ESG is less than the industry average, and the ESG rating is lowered by the three institutions

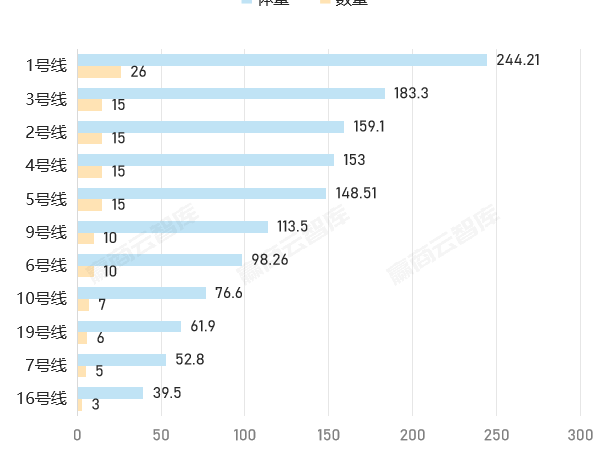

Wind data shows that as of the latest closing date (March 21, 2024), the Wind ESG score of Boatling’s Wind ESG score is 5.39 points.Chuangyuan’s comprehensive score is 7.4 points.

From the perspective of the industry ranking, the Wind ESG comprehensive score of Boatling is ranked 125 in the A -share food industry, which is lower than the industry with two -thirds of the industry; Bailong Chuangyuan ranks 8th in the food industry.Essence

From the perspective of rating, as shown in Figure 3, as of the latest rating date, among the 7 rating agencies of Lufute, Wind ESG, Huazheng Index, Shangdao Rongwu, CITIC, China Cyber Carbon and China, and a total of 7 rating agenciesOnly the Ruoding agency’s rating of the Boatling is A -level, and other agencies’ rating of the company is below A.

Among them, Langlang and Zhongxin’s rating of the company are BBB-level; Wind ESG rated the company BB level; Huazheng Index, Shangdao Rong Green, and Lufut’s rating of the company as the company; Hua Hua; Hua Hua; Hua Hua; Hua Hua; Hua Hua; Hua Hua; Hua Hua; Hua’s rating of the company; Hua Hua; Hua Hua; ChinaThe lowest rating of the carbon and the company is the lowest, only CC level.

The ESG rating of Bailong Chuangyuan is relatively higher than the Polarp.As of the latest rating date, many institutions such as Wind ESG, Langlang, Zhongxin, and Tong Ding rated the company to A -level; in addition, the Hua Si Index, Shangdao Rong Green, and Lufut’s rating on the company were BBB, respectively.Level, B+, B, B, and By Cycling, the lowest rating given by Hua Si is the CCC level.

From the perspective of rating changing trends, as of the latest rating date, the rating of the three rating agencies has declined with the performance of the sponsor ESG.

Among them, in the first quarter of 2024, the rating of the Huazheng Index and Zhongzhong’s rating given to the Polaries from the BBB level and AA level of the previous rating to BBB-grade., But the score dropped from 77.41 points to 66.87 points.

(Full text 4227 words)